Adaptive Conjoint Analysis (ACA) was first introduced by Sawtooth Software in 1985 and went on to become the most widely used conjoint software and conjoint analysis technique in the world during the 1990s (Wittink, Huber, and Vriens 1997), (Green 2000). Most recently, Choice-Based Conjoint techniques (including CBC and Adaptive CBC) have become more popular than ACA, but ACA still finds use and has unique benefits for certain situations.

Conjoint (tradeoff) analysis is a technique frequently used for market research applications. Such applications are usually concerned with consumer preference and they attempt to assess the impact of specific product features on overall preference. Products or services are thought of as possessing specific levels of defined attributes, and a respondent's "liking" for a product is modeled as the sum of the respondent's "part-worths" (sometimes called utilities) for each of its attribute levels. For example, attributes for a car could include: Price, Type, Gas Mileage, and Color. Levels of the Gas Mileage attribute might include 15 MPG, 20 MPG, and 25 MPG; and levels for the Type attribute might include: Convertible, Minivan, Compact, and Full Size.

The strength of conjoint analysis is its ability to ask realistic questions that mimic the tradeoffs that respondents make in the real world. Respondents evaluate product alternatives (concepts) described by various attributes and indicate which products they prefer. By analyzing the answers, conjoint analysis can estimate the weights and preferences respondents may have placed on the various features in order to result in the observed product preferences. In contrast to direct questioning methods that simply ask how import each attribute is or the desirability of each level, conjoint analysis forces respondents to make difficult tradeoffs like the ones they encounter in the real world. As in real purchase decisions, buyers cannot get all the best features at the lowest prices.

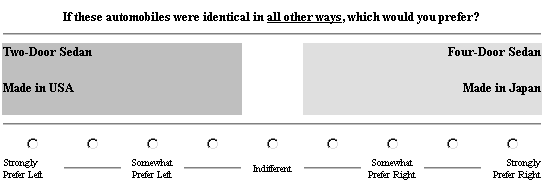

It would be time consuming and difficult for respondents to evaluate all possible product combinations in order to provide information on their values for the various product features. Conjoint analysis offers the researcher a more efficient way to obtain such information: only a carefully chosen set of hypothetical product concepts is presented to respondents for evaluation. For example, a respondent might be asked to choose between the following two concepts:

The answers to this and successive questions are used to determine the respondent's part-worths for each of the attribute levels. Once part-worths have been determined, the respondent's overall utility (preference) for a given product can be estimated by summing the part-worths for each attribute level that describes that product.

Perhaps the most serious practical problem for users of conjoint analysis is that of dealing with large numbers of attributes. Clients often have a detailed understanding of their product category, and previous research has usually identified many issues of interest. The respondent, on the other hand, usually has less interest and enthusiasm, and is rarely willing to submit to a long interview. The researcher is often in conflict. Should there be a long interview, risking unhappy respondents and data of questionable quality? Or should the researcher insist on a narrower focus in the interview, providing the client with less breadth than desired? ACA resolves this conflict by eliminating the tradeoff altogether.

For example, a traditional (non-ACA) full-profile cardsort conjoint study with 12 attributes and four levels per attribute would require estimation of 37 part-worth utilities (the number of attributes x (the number of levels per attribute -1) +1). If the questions presented to the respondent have been well chosen, they will be difficult, perhaps requiring much thought. In addition, under traditional full-profile conjoint analysis, each product concept is described using all 12 attributes, requiring much reading on the part of the respondent. At the very minimum, the respondent would have to provide 37 answers; if there is any random component to the responses we would need more observations. A rule of thumb is to require three times as many observations as parameters being estimated. This would require the respondent to answer 111 questions, each presenting a concept described on 12 attributes. Adaptive Conjoint Analysis solves this problem by customizing the interview for each respondent: the respondent is asked in detail only about those attributes and levels of greatest relevance, and the task is made more manageable due to partial rather than full profiles (only showing a subset (usually 2 to 5) of the attributes in any one question). The term "adaptive" refers to the fact that the computer-administered interview is customized for each respondent; at each step, previous answers are used to decide which question to ask next, to obtain the most information about the respondent's preferences.

Once the data are collected, ACA lets the researcher simulate respondent preferences for new or modified products. The Market Simulator can be used to explore "what if" scenarios, such as changes in product formulation. The researcher describes a group of hypothetical products by specifying each product's level on each attribute. Respondent part-worth utilities are used to estimate strengths of preference or buying likelihoods for each product, and results are accumulated over respondents to provide shares of preference among competing products or average estimated buying likelihoods for each product.